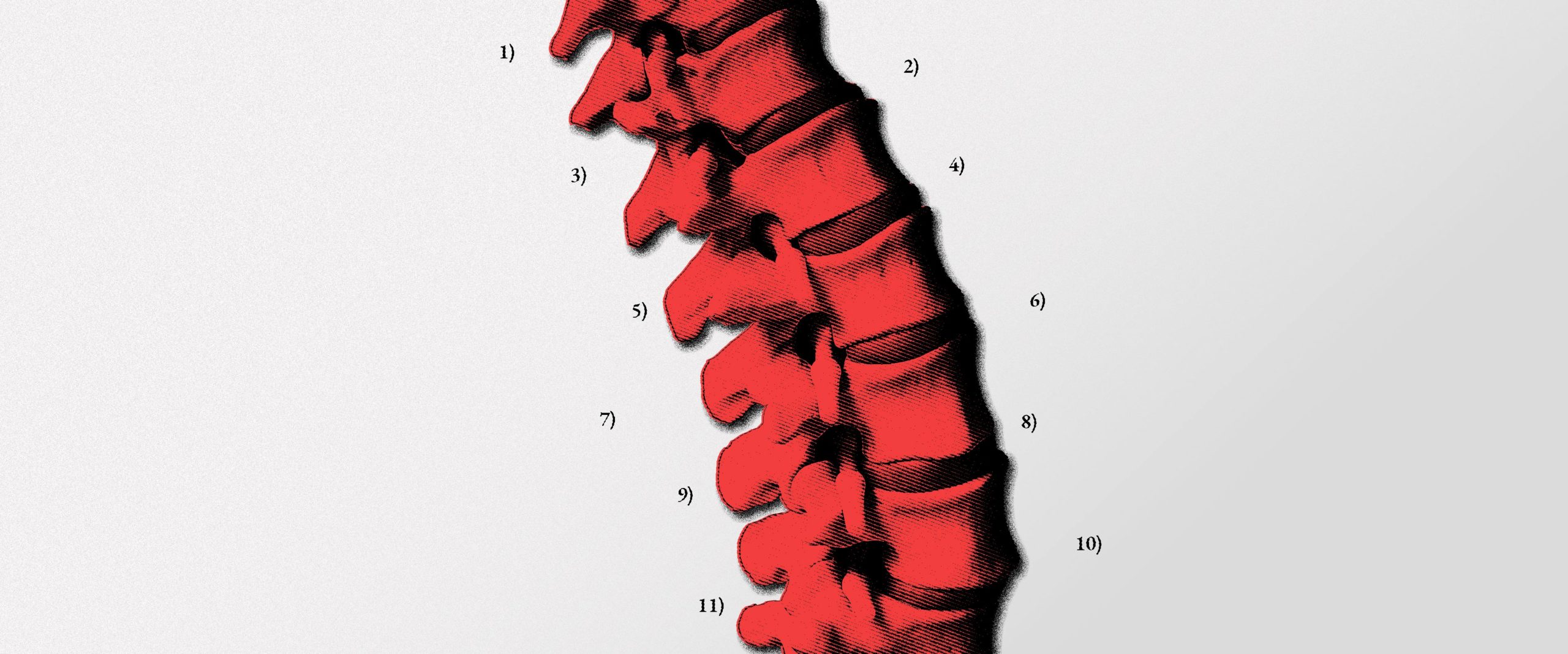

Sanctions: 11 Things You Need To Know

Over the last decade, reliance on economic sanctions as the spinal cord of western foreign policy has dramatically increased the risks for businesses with an international footprint. The sheer number of countries that now feature in international or domestic sanctions regimes mean that anyone engaging, even indirectly, in any dealings involving such countries faces huge challenges in ensuring that they stay the right side of the law. For any business, it is critical to be aware of the following key points:

- The landscape can change very quickly in response to events

Over the last decade we have seen sanctions targeting multiple parties, within days of developments on the world stage, such as the Arab Spring, Russia’s annexation of Crimea, the downing of a Malaysian passenger plane and the poisoning of Russian activist Alexei Navalny. - Sanctions are pervasive

Economic sanctions can impact on all aspects of commercial operations, capturing any direct or indirect dealings with money, goods, technology or services. Whilst the risk of breach will vary between economic sectors and jurisdictions, there is, in principle, no aspect of a business that is immune to the risk of sanctions. - Extraterritoriality

Unlike the reach of most other laws, a country’s sanctions jurisdiction typically extends – at least – to activity taking place outside its territory, when carried out by its nationals and its legal entities. - Competing liability

Given the pervasiveness and jurisdictional reach of economic sanctions regimes, there is a high degree of probability that multiple sanctions will apply at any given time to one and the same activity. It follows from this that it is also almost inevitable that those involved in the activity may be subject to potentially or actually conflicting requirements. - Conflict of laws may arise

Economic sanctions are instruments of a nation/bloc’s foreign policy, and will sometimes conflict, creating legal confusion. When in 2018 the United States withdrew from the Joint Comprehensive Plan of Action (JCPOA) on Iran, the remaining signatories turned to the EU’s ‘blocking’ Regulation to stop EU operators from complying with the reimposed US sanctions. For the EU operators, the choice then became whether to comply with US or EU law. - Uncertainty prevails

Twenty-five years after the EU’s Blocking Regulation was first adopted, there is still precious little clarity on how it should be interpreted. The same can be said for the UK’s separate blocking regime, and the blocking regimes increasingly adopted by other countries. - Inconsistency of Enforcement

The US remains the world’s most active sanctions enforcer, with swingeing fines and prosecutions for sanctions breaches, albeit the UK authorities are beginning to show real teeth and initiatives are underway to ensure that the EU Member States do not lag far behind. - Secondary sanctions matter

In circumstances when US sanctions do not apply, access to the US financial system can still be denied to those who are considered to provide material assistance to certain US-sanctioned parties. For as long as the US financial system maintains its dominance, this threat is likely to remain highly effective in practice in policing the behaviour of those outside the reach of US jurisdiction. - The impact is draconian

Famously described as ‘a financial death penalty’, the immediate effect of financial sanctions on a designated party is a blanket asset freeze, subject to limited exceptions. The fall out in practice is typically an equally immediate disruption of business, while counterparties and suppliers take stock of their positions. - Little evidence is required to sanction

Generally speaking, the threshold for designations is set low, and will be satisfied by some demonstrable basis for concluding that the target is engaged in activity attracting sanctions – whether that be nuclear or chemical weapons proliferation or other criminal activity such as corruption, or activity undermining the rule of law and democracy, including human rights. Reliance is often placed on online media and NGO reports, as supporting evidence. - The legitimacy of sanctions depends on their use continuing to making sense

There is a raging debate on the political and legal parameters of sanctions, and opinions are very much divided. Despite the lack of consensus on key points of principle, there is no prospect of the use of sanctions slowing. For the international business community, navigating this increasingly complex set of rules is set to remain a significant challenge.